In OCS.io, calculating Taxes is critical to the Rating & Charging process. The system offers out-of-the-box functionality to calculate taxes, which involves adding a defined tax rate to each event during Online Rating & Charging or a group of events with the same tax category during the Billing process. This functionality is suitable for businesses or tax jurisdictions with straightforward tax calculation requirements, such as most EU countries.

The system allows for the unlimited definition of tax rates, including standard rates (e.g., 19%), reduced rates (e.g., 5%), and no-tax rates (with a value of 0%). However, suppose your business or tax jurisdiction requires more complex Taxation, such as in the United States of America. In that case, the system offers the option to configure no-tax rates and process taxation using an external vendor, such as Vertex.

| For more information on tax configuration and customization, refer to the documentation on Taxation. |

To configure Taxes, follow these steps:

-

Access the Core Configuration perspective in the OCS.io user interface.

-

Select the .

-

Click on the + (New) button to create a new Tax.

-

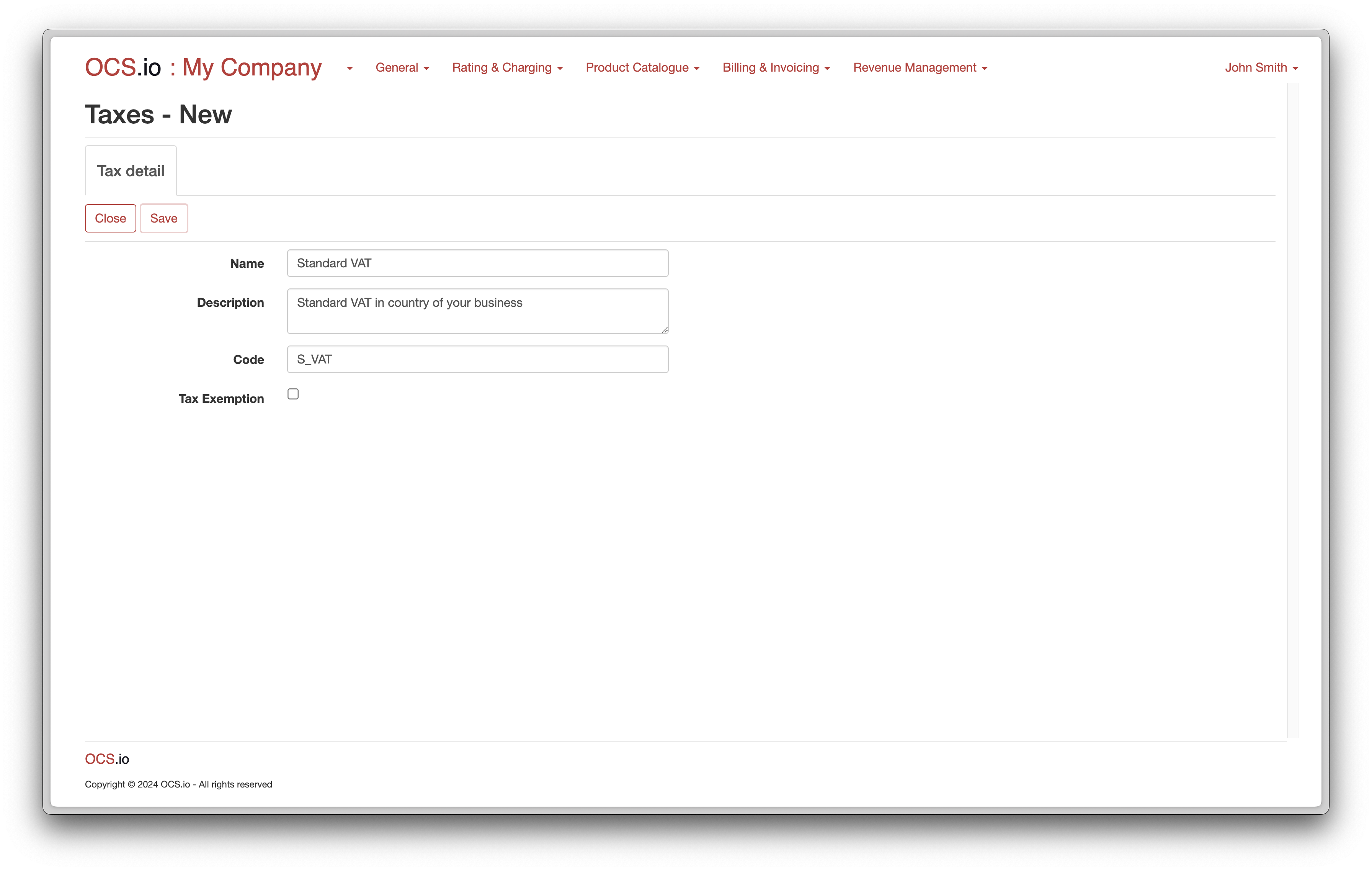

Fill in the required information in the form:

Item Description Name

Enter the name of the Tax.

Description

Optionally, enter the description of the Tax.

Code

Enter the External code to which the Tax will be mapped in the result of rating, charging, and billing.

Once you click on the Save button, the Value History tab will be shown. Here, you can configure different values of the Tax for different time periods.

-

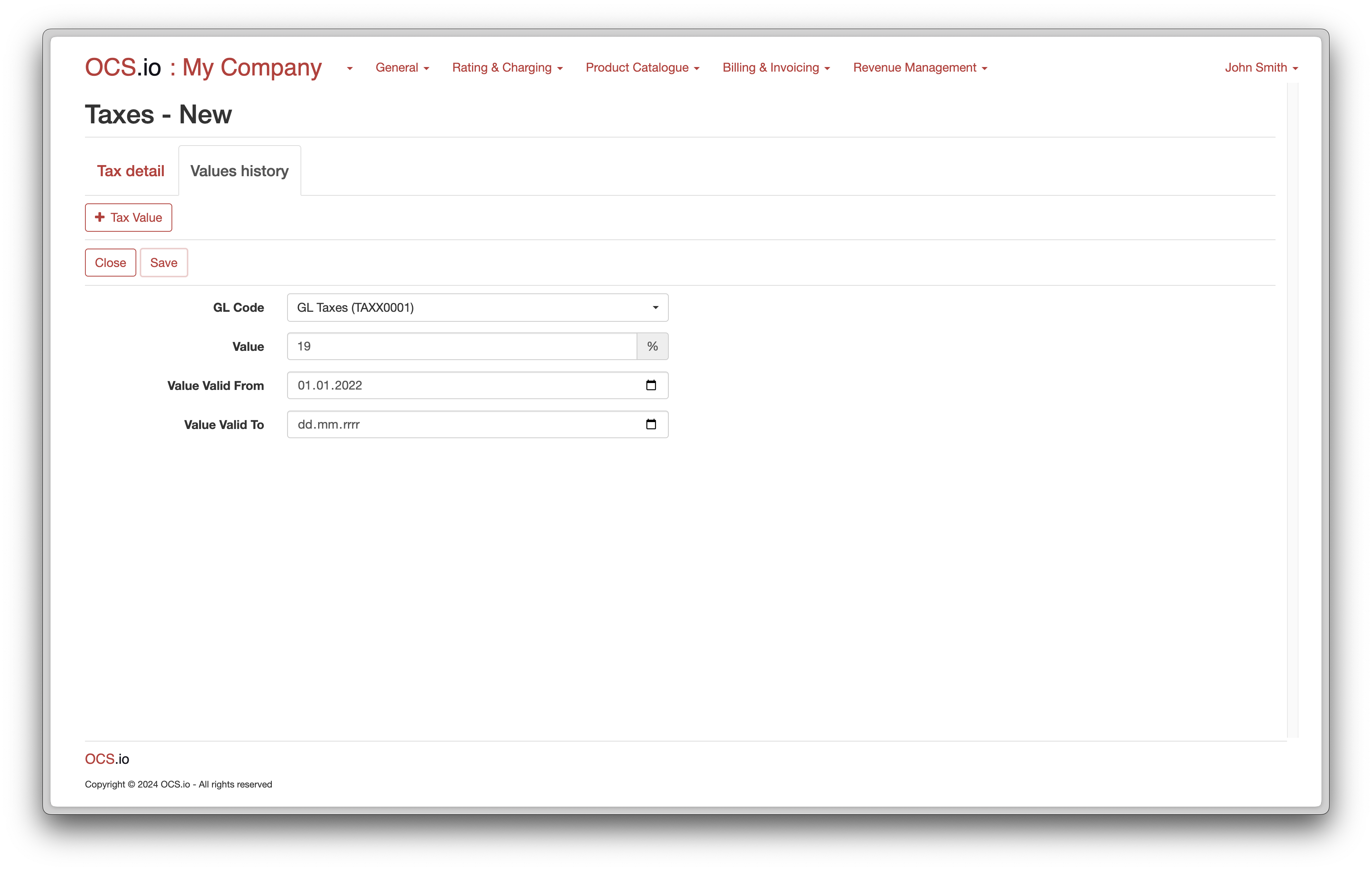

Click on the + (New) button in the Values History tab to add a new Tax value.

-

Fill in the required information in the form:

Item Description GL Code

Choose the GL Code which will be assigned to the Tax.

Value

Enter the Tax Value. The value should be entered as a percentage, e.g., 19 for 19%. You can enter precision up to 2 decimals.

Value Valid From

Enter the date from when this Tax Value is valid.

Value Valid To

Enter the date till when this Tax Value is valid. When no value is entered, the Tax Value is valid indefinitely.